net investment income tax brackets 2021

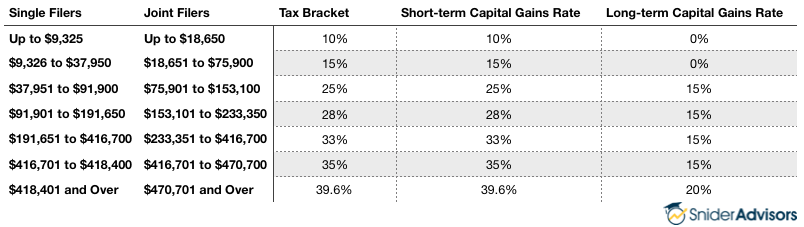

In the US short-term capital gains are taxed. 1 It applies to individuals families estates and trusts.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Net Investment Income Tax.

. There are seven federal tax brackets for the 2021 tax year. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income. These are the rates for.

Was age 18 at the end of 2021 and didnt have earned income that was more than half of the childs support or. Here are the 2021 and 2022 federal income tax brackets. Each year the IRS adjusts the tax brackets for inflation.

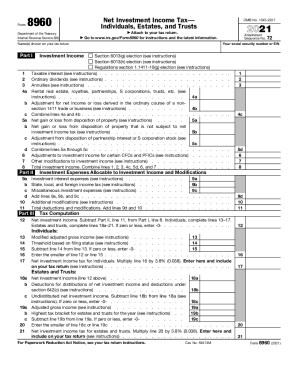

Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. Form 8960 opens in new tab to calculate the surtax. April 28 2021 The 38 Net Investment Income Tax.

For 2021 the tax bracket thresholds were increased by approximately 1 over 2020 levels. What Are the Capital Gains Tax Rates for 2022 vs. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts.

Most investment income is taxable but there are a few strategies for avoiding or at least minimizing the taxes you pay on investment returns. Definitions Controlled foreign corporation CFC. 17 Estates and Trusts.

A the undistributed net investment income or B the excess if any of. 10 12 22 24 32 35 and 37. You are charged 38 of the lesser of net investment income or the amount by which the MAGI exceeds the income thresholds you must pass to incur NIITs.

Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

A Married Filing Jointly household has 300000 in income from self-employment and. Net investment income tax for individuals. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file.

Change in tax rates. Your Net Investment Income Tax NIIT. Enter here and include on your tax return see instructions.

The investment income above the 250000 NIIT threshold is taxed at 38. To clarify the 2021 tax. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an.

Surtax on Net Investment Income. A child whose tax is. Stay in a low tax bracket.

If youve held an asset or investment for one year or less before you sell it for a gain thats considered a short-term capital gain. 2021 tax brackets are provided for those filing taxes in April 2022 or in October 2022 with an extension. Your bracket depends on your taxable income and filing status.

Multiply line 16 by 38 0038.

2021 Tax Thresholds Hkp Seattle

Capital Gains Tax What Is It When Do You Pay It

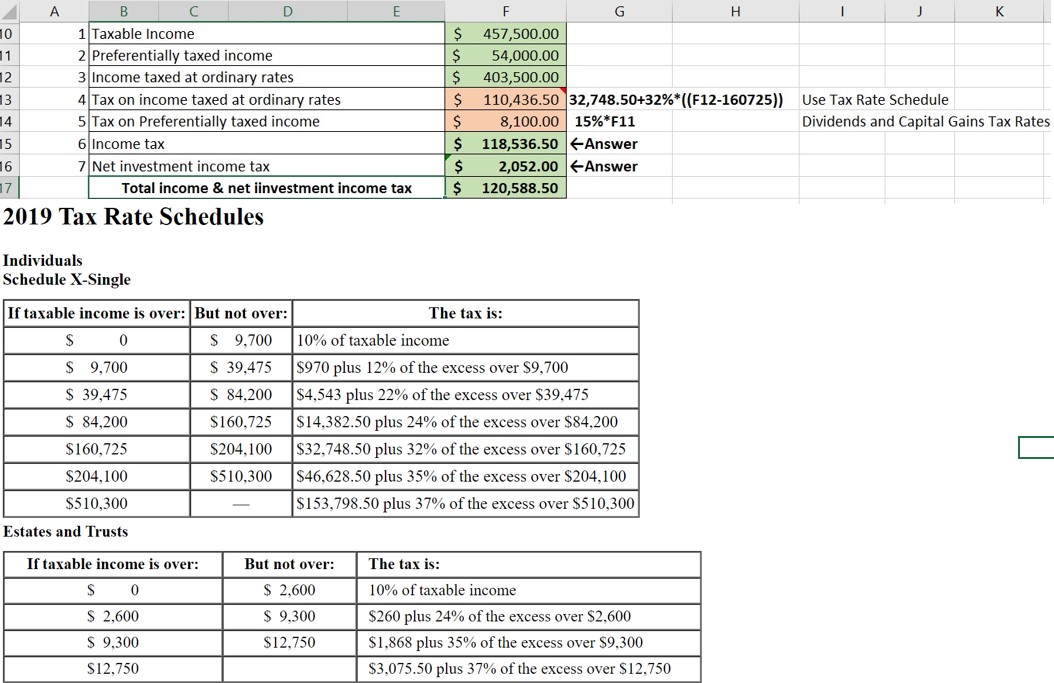

Answered Required Information The Following Bartleby

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

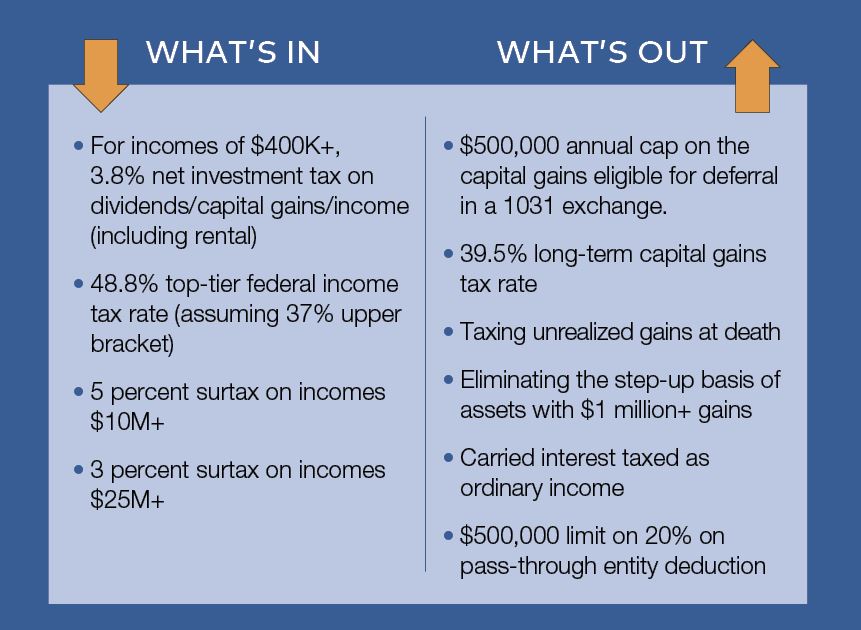

Year End Tax Planning Thoughts For An Uncertain Political World Bmo Harris Bmo Harris

Baseline Estimates Tax Policy Center

Net Investment Income Tax Niit Quick Guides Asena Advisors

Tax Policy Largely Stays The Course For Cre Execs Commercial Property Executive

Form 8960 Instructions 2021 Fill Out And Sign Printable Pdf Template Signnow

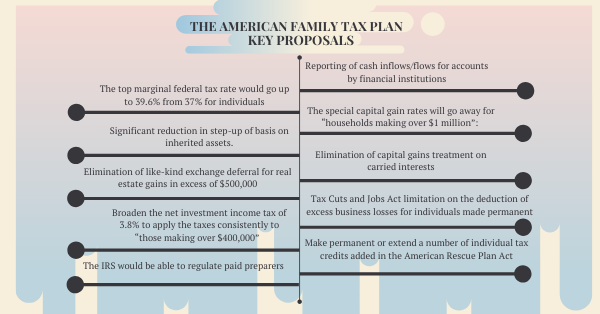

A Look At The American Families Plan Center For Agricultural Law And Taxation

The American Family Tax Plan Nstp

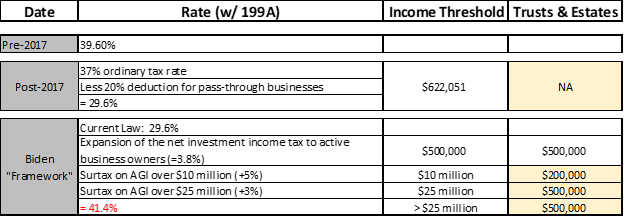

Assault On Family Businesses Continues The S Corporation Association

Capital Gains Tax Definition Taxedu Tax Foundation

9 Common Questions About Investment Income Tax

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

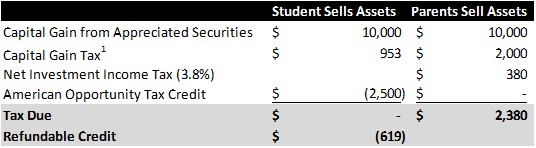

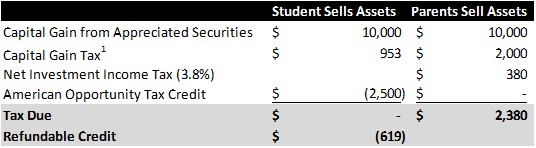

Children As Dependents Kiddie Tax And College Tax Planning Strategies Updated Resource Planning Group

New Brackets Net Investment Income Tax Expand Scope Of Tax Planning

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Helpful Information For Filing 2020 Income Taxes And Proactive Tax Planning For 2021 Capital Income Advisors